|

|

|

|

|

|

|

|

|

|

|

Registered

|

Wall Street effect on price of fuel we pay

Interesting perspective...

Gas prices: How Wall Street helps pump prices defy supply and demand - Olive - thestar.com

__________________

1980 911 ROW SC Coupe 2014 BMW 328i touring 1999 Porsche 911 C2 |

||

|

|

|

|

1966 - 912 - SOLD

Join Date: May 2008

Location: oak grove, OREGON

Posts: 3,193

|

Daily Kos: DeFazio is trying to make the Gas Speculators pay

"by Charles Pope, The Oregonian -- March 07, 2012 [...] In a letter to Obama delivered Wednesday, DeFazio argued that "for the last decade, rising speculation in the oil markets has added considerable volatility to the price of oil. The bottom line is that oil speculation is artificially jacking up gas pump prices." DeFazio then asks Obama to formally endorse a bill he introduced last year that would levy a "0.01 percent excise tax on transactions in oil futures, options, and swaps" that DeFazio says would curtail speculation and price swings at the pump. "By charging a minuscule 0.01 percent tax (1 basis point) on derivatives of crude oil, speculators would be dissuaded from excessive speculation. Oil prices will then return to accurate price discovery following the supply and demand price curve. American drivers will see fair gas prices and our economy will not be further constrained by excessive oil speculation," DeFazio said in the letter."

__________________

i was too tired to be pretty last night! |

||

|

|

|

|

Registered

|

Would a one cent tax really do all that much?

__________________

1977 911S Targa 2.7L (CIS) Silver/Black 2012 Infiniti G37X Coupe (AWD) 3.7L Black on Black 1989 modified Scat II HP Hovercraft George, Architect |

||

|

|

|

|

1966 - 912 - SOLD

Join Date: May 2008

Location: oak grove, OREGON

Posts: 3,193

|

i realy don't know? but this seems to be the idea that several folks are throwing out there-

what is the volume of speculation?

__________________

i was too tired to be pretty last night! |

||

|

|

|

|

Registered

Join Date: Dec 1999

Location: Ft. Collins, CO USA

Posts: 383

|

I believe the article said that about 64% of the volume is specualtive trading nowadays.

I am all for this passing. I would like to see it refined (no pun intended) somewhat so only the Wall Street speculators have to pay the surtax, and refiners and other oil related business don't. If it could be worked out this way, I would be for the tax being hiked to 15 % or so. Speculators have no business buying crude, they are screwing eveybody world-wide with their greed. I am usually a free-market capitalist type guy, but I am all for crude being taken off the public trading block. Craig

__________________

77 Ice Green 911s w/3.0 |

||

|

|

|

|

Unregistered

Join Date: Aug 2000

Location: a wretched hive of scum and villainy

Posts: 55,652

|

The price of crude is artificially inflated by speculators, of that there is no doubt.

Investors buy a future delivery, sit on it, and then sell it when the price increases. It artificially decreases supply temporarily which drives the price up. I'd like to see a law that says if you buy a crude delivery you have to physically receive it before you can sell it, or you go to jail. If we could do that internationally it would instantly drive the drive down to around $60/bbl. If we could just do it in the US it would drive the price down to $80. |

||

|

|

|

|

|

Registered

Join Date: Mar 1999

Location: Vancouver,Wa.

Posts: 4,457

|

I have read that there are tankers full of oil sitting in anchorages all over the world and this is not new news. The "take delivery" bit won't work.

All commodity markets are run to be advantageous to the speculator cause that's where the money is. Much of the trading in commodities markets are on commodities that don't even physically exist. Longs, shorts, hedges(?) & God knows what else. Your government allows this so bend over & quitcher' whinin'.

__________________

JPIII Early Boxster Last edited by J P Stein; 03-30-2012 at 05:51 PM.. |

||

|

|

|

|

Registered

|

Quote:

__________________

. |

||

|

|

|

|

Work in Progress

|

You want oil to be cheaper stop printing dollars like they are toilet paper. Every commodity has increased a significant margin. From gold to oil to you name it. Sure speculation may impact the prices in the short term, but the long teem fundamental change has little to do with speculation. If anyone including the author had the scoop on the actual intrinsic value of oil I I'm confident you will find some to finance your short positions. My guess its though that those 60 hunches are as accurate as tossing a dart at a board.

__________________

"The reason most people give up is because they look at how far they have to go, not how far they have come." -Bruce Anderson via FB -Marine Blue '87 930 |

||

|

|

|

|

Too big to fail

|

Quote:

I guess the Mayans were right after all...

__________________

"You go to the track with the Porsche you have, not the Porsche you wish you had." '03 E46 M3 '57 356A Various VWs |

||

|

|

|

|

Registered

Join Date: Mar 1999

Location: Vancouver,Wa.

Posts: 4,457

|

Quote:

__________________

JPIII Early Boxster |

||

|

|

|

|

Information Junky

Join Date: Mar 2001

Location: an island, upper left coast, USA

Posts: 73,167

|

So are speculators also responsible for sending gas prices to extreme lows? - think they are.

The thing is, cheap energy is the grease of the economy. ...it makes everything we do easier. The fundamental here in the US is that the current admin has been focused on steering us away from cheap energy, in great Hope of making the expensive (alternative) energy cheap. Part of that strategy has been restricting domestic oil on govt land such that the alternative looks better by comparison. Of course, those pet (alt) energy projects have failed miserably. Oil prices shot up, causing all sorts of old oil wells (expensive to run) to start back up. IOW, even the expensive oil still is cheaper to get than subsidized alternative energy. Energy prices will go back down when political obstacles are pushed aside for the sake of a prosperous nation.

__________________

Everyone you meet knows something you don't. - - - and a whole bunch of crap that is wrong. Disclaimer: the above was 2¢ worth. More information is available as my professional opinion, which is provided for an exorbitant fee.

|

||

|

|

|

|

|

Registered User

|

No because speculators would find a way to pass it on to consumers. Regulation and enforcement of existing regulations are the key but that smacks of big government and that is a Romper Room no-no around PARF. One way or another the existing majority on PARF will find a way to blame Obama.

|

||

|

|

|

|

Information Junky

Join Date: Mar 2001

Location: an island, upper left coast, USA

Posts: 73,167

|

Ronster -There are two things going on here; price volatility and supply/demand changes.

For price volatility, blame the speculators (who watch daily world politics for planned supply cuts and inflation) For the supply side. . . consider that Energy sec Chu just recently backed away from comment about how he would like to see US gas prices equally high to European gas prices. ($9 gas, for the good of the country) So don't go implying that teamO has nothing to do with increased energy prices. ...Trillions of new dollars infused drives inflation. Restricting new oil drilling permits cuts supply. (guess who is doing that)

__________________

Everyone you meet knows something you don't. - - - and a whole bunch of crap that is wrong. Disclaimer: the above was 2¢ worth. More information is available as my professional opinion, which is provided for an exorbitant fee.

Last edited by island911; 03-31-2012 at 09:32 AM.. |

||

|

|

|

|

Registered

|

Quote:

Actually, we don't know who really owns half these ships. It's one shell tax evading corporation owning another.

__________________

1977 911S Targa 2.7L (CIS) Silver/Black 2012 Infiniti G37X Coupe (AWD) 3.7L Black on Black 1989 modified Scat II HP Hovercraft George, Architect |

||

|

|

|

|

Unregistered

Join Date: Aug 2000

Location: a wretched hive of scum and villainy

Posts: 55,652

|

Re: printing dollars..................

When a gubmint goes crazy and spends trillions it doesn't have and then borrows to cover it, it has only two options. 1) try to pay back the money it borrowed (which it can't) so it defaults....... or 2) prints enough money to devalue the money already borrowed to make it easy to pay back the debt. In other words if I borrow a million from you and the next day a million isn't worth anything, then I basically owe you nothing. I jones'd out of the debt. BUT that only works if I stop borrowing money. If I keep borrowing money eventually I'll still go into default because I can only devalue my own currency so far and so many times before getting into real trouble, like having the Chinese take over. The other downside is that whenever the money becomes worth less, it takes more to buy stuff. (see jiminy carter). Inflation goes nuts, people's paychecks don't buy as much, people get poorer and the economy goes into recession, or stays there as in our case. But hey, as long as the sheeples are dumb you can just blame it on the other guy and they won't know the difference. What could go wrong? |

||

|

|

|

|

Registered

Join Date: Dec 2001

Location: Cambridge, MA

Posts: 44,707

|

Quote:

My understanding is that all the new money printed by the Fed is in banks (Financial economy), not in general circulation (Main Street economy), so it hasn't effected inflation on the scale it could, yet. on a tangent, I would expect the developing Middle Classes in India and China to have a greater impact on inflation in the U.S. economy than printing money. Everything is getting more expensive due to higher labor rates overseas.

__________________

Tru6 Restoration & Design Last edited by Shaun 84 Targa; 03-31-2012 at 11:23 AM.. |

||

|

|

|

|

Work in Progress

|

Quote:

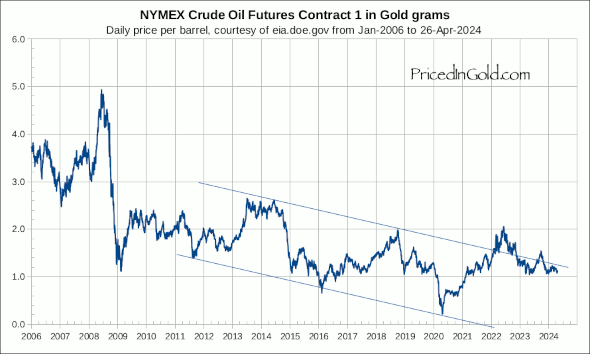

Evil speculators aren't waiting for the Fed to tell them that inflation is actually running closer to 5%, they are taking action today. I've heard one hot commodity for hedge funds lately has actually been farmland (on the assumption it is a good inflation hedge). SO whether the money is hitting main street today or tomorrow doesn't matter, speculators are preparing for it today. Which is why I will still stick to my toilet paper argument, a stonger dollar will curtail investments in commodities. I have no idea which force will have a larger impact on inflation in $ terms, foreign wage inflation or domestic dollar production. I just know we are in hot and heavy dollar production mode and the fed continues to hint at turning the heat up. If you price oil in terms of gold it doesn't look too terribly expensive on a historical basis:

__________________

"The reason most people give up is because they look at how far they have to go, not how far they have come." -Bruce Anderson via FB -Marine Blue '87 930 |

||

|

|

|

|

canna change law physics

|

Quote:

I expect the rest is speculation, supply disruption and general increase in the demand for oil by place like India and China.

__________________

James The pessimist complains about the wind; the optimist expects it to change; the engineer adjusts the sails.- William Arthur Ward (1921-1994) Red-beard for President, 2020 |

||

|

|

|

|

Registered

Join Date: Jul 2006

Location: Rockaway, NJ

Posts: 313

|

After reading this last week , it's now understandable that prices are that high, despite that fact that we are actually exporting more oil than importing. Consumption actually sank in the US, which should drive the prices down or at least stabilize them!

U.S. Was Net Oil-Product Exporter for First Time Since 1949 - Bloomberg

__________________

'07 Cayman '90 911 - SOLD '05 Boxster (for the wife!) '85/1 944 - SOLD |

||

|

|

|