Quote:

Originally Posted by KC911

You've got it ALL wrong imo. The "cheap, easy credit" of ultra-low FED rates are exactly the "cause" of this crap. The FED rate absolutely needs to go back to traditional levels....and we are NOT there yet. What do YOU think the FED prime rate should be? Serious question. Will it have a negative impact on growth? Absolutely....just like it has been since '15...

The recent GDP growth numbers don't come close to growth a couple of qtrs in 2014 btw.

Just saw my R Congressman being interviewed.....he said increasing the national debt was nothing to be concerned about. I think he's an idiot  . Is that PARFY  ? |

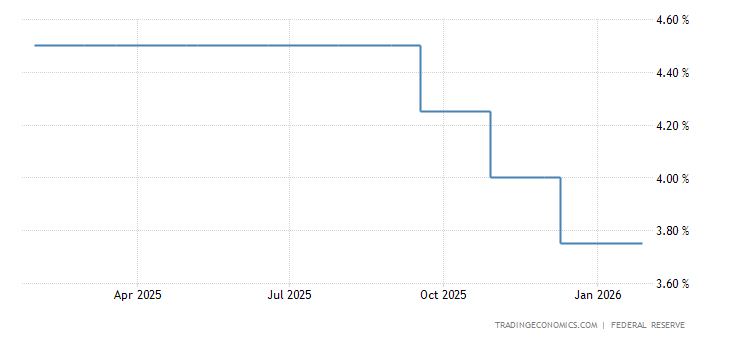

For 8 years it was just about at Zero, how much has it gone up in the last 18 months?

We cannot go back to traditional levels, if our Federal Debt was not 21 Trillion we could, but not at 21 Trillion in Debt, if we go back to 80's level interest rates, our Debt will skyrocket.

We have driven off a cliff and cannot turn around, this is honestly fodder for another thread.

Right now, we have an economy that is on a rebound, we need to ease back into the interest rates slowly.

It was said back in 2016 if the interest rates rise, the United States will be in big trouble with unsustainable national debt. Interest rates are rising, how much more? Good question, I am not sure. I do know big damage is being done, we need, more than anything, to get the national debt heading backwards, I do not think that will ever happen, instead I think our national credit rating is going to take a huge hit.

Then forget recession think Venezuela.

Here!! Have a Kachi style graph.