|

|

|

|

|

|

|

|

|

|

|

I'm with Bill

Join Date: Feb 2005

Location: Jensen Beach, FL

Posts: 13,028

|

Quote:

Since I am tied directly into home sales and home sales seems to be a great indicator as to how healthy or unhealthy the economy is. People buy houses when they feel like things are going good. I saw a big drop off in closings in October and November is starting off pretty slow too. My builders are all balls to the wall but they never seem to read the market and tend to overbuild until there is huge inventory just sitting. Then many go bankrupt. I think a big factor this time around will be student loans and car loans along with Credit cards. Cars are now the same price houses were 20 years ago and there is no regulation on who can or cannot get a car loan like the mortgage business. You can now finance a car for 7+ years. Which is insane except it seems like everyone is doing it. Same goes for student loans and same goes for credit card debt, all unsecured credit and both at all time record highs. Throw in the Fed increasing interest rates and this turns into a fine mess. I am not going into Tabs land the our Federal Debt, that is another thread. I read an article, I do not have time right now to find it, it said we will look back at October 2018 and realize it was the start of the downturn in the economy. I hope they are wrong.

__________________

1978 Mini Cooper Pickup 1991 BMW 318i M50 2.8 swap 2005 Mini Cooper S 2014 BMW i3 Giga World - For sale in late March |

||

|

|

|

|

FUSHIGI

Join Date: Feb 2006

Location: somewhere between here and there

Posts: 10,802

|

where is the guy who's predicted 134 of the last 3 recessions?

|

||

|

|

|

|

I'm with Bill

Join Date: Feb 2005

Location: Jensen Beach, FL

Posts: 13,028

|

I used to like Peter Schiff but he seems to just be interested in scaring people into using his services, he has been predicting doom and gloom non stop for 5 years now.

__________________

1978 Mini Cooper Pickup 1991 BMW 318i M50 2.8 swap 2005 Mini Cooper S 2014 BMW i3 Giga World - For sale in late March |

||

|

|

|

|

Registered

Join Date: May 2013

Location: Upper Midwest

Posts: 1,190

|

I think this describes most of the pundits you see/hear.

__________________

Who, What, When, Where, Why and How. |

||

|

|

|

|

?

Join Date: Apr 2002

Posts: 30,726

|

Quote:

The recent GDP growth numbers don't come close to growth a couple of qtrs in 2014 btw. Just saw my R Congressman being interviewed.....he said increasing the national debt was nothing to be concerned about. I think he's an idiot  . Is that PARFY . Is that PARFY  ? ?

|

||

|

|

|

|

Brew Master

|

Quote:

I don't see Q1 being the start of a recession since things would have to go south drastically. If anything I'd say late 2019 early 2020

__________________

Nick |

||

|

|

|

|

|

Unregistered

Join Date: Aug 2000

Location: a wretched hive of scum and villainy

Posts: 55,652

|

Quote:

But recently I sold off seven figures of stocks and sunk em into precious metals and money market. we'll see what happens after the elections. BTW the FED is EVIL. They are the cause, the source, the scourge. When things go bad it's usually the FED's fault. |

||

|

|

|

|

?

Join Date: Apr 2002

Posts: 30,726

|

How much "unsustainable juice" (debt) was applied to get the last 2 qtrs GDP bump....verses '14? We might "barely" hit 3% for this year...but not in 2019....just ain't gonna happen imo. Nothing to do with tomorrow either...it's just not gonna. I hope I'm wrong....

|

||

|

|

|

|

?

Join Date: Apr 2002

Posts: 30,726

|

Mebbe a topic for another thread....what do y'all think is the "sweet spot" for the FED prime rate? It absolutely needs to be over a 100 basis points higher than it is now. The FED has it's faults, but it also covered EVERY one of our butt$ ten years ago. Without the FEDs actions (like them or not)....where do you think we'd be now?

I'd like to see the FED prime rate return to around 3.5%...give or take. |

||

|

|

|

|

Dog-faced pony soldier

|

I think there may be one looming. There is a humongous bubble in the stock market today and there’s also a bubble that’s formed in the RE market and worse still we still aren’t “really” recovered from how bad 2008-09 was.

We’re fully ten years out from that recession and the federal reserve still has VERY low interest rates and billions of dollars of junk / bad / “subprime” debt on its books (and will for decades) created during the stupidity of the housing bubble of the mid-2000s. While I don’t see what’s coming as catastrophic, I think it will last longer than it “should” and be slower to recover than has been the case historically simply because the federal reserve doesn’t have the tools to juice the economy when needed - they used every tool in the toolbox to keep the ship afloat during the time from 2008-2012 or so and has STILL (ten years later!) been reluctant to raise rates. We also STILL are seeing anemic wage growth. Only very recently has there been an uptick in salaries... It has taken a very, very long time to haplen and won’t have much time to “marinate” before there is downward pressure on salaries again. That can’t help matters... There’s a lot of money out there but most of it is consolidated with the very, very wealthy. None of that helps. I suspect in the next 2-3 years there will be a downturn for a year or so, followed by sloooooooow, lackluster growth (think 2013-2016). Last edited by Porsche-O-Phile; 11-05-2018 at 04:02 PM.. |

||

|

|

|

|

Brew Master

|

I still say things are going to have to make a drastic turn in 2019 for it to not perform like 18 has or really since the second quarter of 2017 forward has. When we get things sorted out with China, and we will, I think 2019 will be better than 18. I hope I'm right! but mostly for selfish reasons, I'm having a GREAT 2018 and activity for Q4 is MUCH stronger than Q3 and close to Q2 for me. There's a lot of money out there and I'm going to enjoy it and make the most of it while it lasts.

__________________

Nick |

||

|

|

|

|

Registered

Join Date: May 2013

Location: Upper Midwest

Posts: 1,190

|

p-o-p

I agree. I think we are still in uncharted waters and the Fed and government would not have all the options/tools normally available to them when the slowdown occurs. And look at the rates in Europe. Everytime I think about all the debt out there, cars, college, state, governments (pension obligations), I get real nervous.

__________________

Who, What, When, Where, Why and How. |

||

|

|

|

|

Registered

Join Date: Dec 2001

Location: Cambridge, MA

Posts: 44,602

|

Cheap money cum corporate debt bubble

No wage growth Trade and tariff uncertainty ultimately netting out to inflation Protectionism Banking deregulation More buyers than sellers in the stock market Tax cuts National debt at $22 trillion What could go wrong?

__________________

Tru6 Restoration & Design |

||

|

|

|

|

I'm with Bill

Join Date: Feb 2005

Location: Jensen Beach, FL

Posts: 13,028

|

Quote:

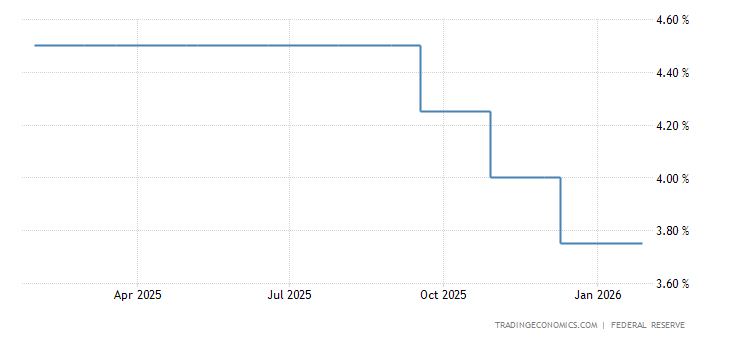

We cannot go back to traditional levels, if our Federal Debt was not 21 Trillion we could, but not at 21 Trillion in Debt, if we go back to 80's level interest rates, our Debt will skyrocket. We have driven off a cliff and cannot turn around, this is honestly fodder for another thread. Right now, we have an economy that is on a rebound, we need to ease back into the interest rates slowly. It was said back in 2016 if the interest rates rise, the United States will be in big trouble with unsustainable national debt. Interest rates are rising, how much more? Good question, I am not sure. I do know big damage is being done, we need, more than anything, to get the national debt heading backwards, I do not think that will ever happen, instead I think our national credit rating is going to take a huge hit. Then forget recession think Venezuela. Here!! Have a Kachi style graph.

__________________

1978 Mini Cooper Pickup 1991 BMW 318i M50 2.8 swap 2005 Mini Cooper S 2014 BMW i3 Giga World - For sale in late March Last edited by Jims5543; 11-05-2018 at 04:47 PM.. |

||

|

|

|

|

Super Moderator

|

You win the internet today sir.

__________________

Chris ---------------------------------------------- 1996 993 RS Replica 2023 KTM 890 Adventure R 1971 Norton 750 Commando Alcon Brake Kits |

||

|

|

|

|

?

Join Date: Apr 2002

Posts: 30,726

|

Quote:

Appreciate the exchanges with you all, but just have a different perspective. This is gonna play out...and we'll see. I have ZERO interest in making a case with graphs and statistical bs however....and I'm pretty good at that too... At the end of '19, the FED prime rate WILL be in the range I refer too, and GDP will be under 3% for the year too...jmho. ....and I ain't even got one of them crystal ball thingys like Samny does...I gots TWO  ! !

|

||

|

|

|

|

Brew Master

|

Quote:

__________________

Nick |

||

|

|

|

|

I'm with Bill

Join Date: Feb 2005

Location: Jensen Beach, FL

Posts: 13,028

|

Quote:

House prices are now falling, I think a good thing, except no one is buying. So now there is a lot of inventory, the builders are too dumb to realize what is going on and are frantically building as many houses at they can as fast as they can. I see 2006 all over again right now and I hope I am wrong. I usually receive 6 orders a day for closings, I am averaging 1 a day to 1 every 2 days. The only thing keeping me busy right now is my tract home builder and my 3 custom home builders. The tract home builder is starting up 50+ houses a month. As I mentioned earlier, I am shell shocked from the 2008 crash, I was lucky and saw it coming in 2007, sold off RE, sold off toys, and got ready for 2 bad years, I never expected 6 bad years. In 2011 I was about to close my doors and go find a job somewhere doing something else. Also as mention I read an article that said we will look back at Oct 2018 as the beginning of another housing crash, I really hope they are wrong. I am heading out on several jobs today for closings, I let them build up over the last week. Then I am counting on the builders to keep me busy again. I hooked up with the biggest pool company in town, they used to order a new pool job every day sometimes 2-3 a day. We are down to 1-3 a week if that. I hope I am seeing this wrong. I think I am grabbing more gold this week. Interesting article on National Debt. I typed out a long response to KC but he tapped out of this thread so I deleted it. https://www.thebalance.com/interest-on-the-national-debt-4119024

__________________

1978 Mini Cooper Pickup 1991 BMW 318i M50 2.8 swap 2005 Mini Cooper S 2014 BMW i3 Giga World - For sale in late March |

||

|

|

|

|

|

?

Join Date: Apr 2002

Posts: 30,726

|

I wish you had posted it Jim...sometimes I lie like a politician

....and I appreciate your posts and perspective....I just have a TOTALLY different perspective on "easy credit". The FED is nothing more than the "bankers' bank".... giving these large entities free, or low interest loans to make their billions ....and I appreciate your posts and perspective....I just have a TOTALLY different perspective on "easy credit". The FED is nothing more than the "bankers' bank".... giving these large entities free, or low interest loans to make their billions  ? You're a "go getter" and I admire that..... ? You're a "go getter" and I admire that.....I've also worked for two of the megabanks (one defunct) though my expertise is in IT and quantitative analysis. You don't give a drunk a shot of "juice" when the DTs hit....painful as it is imo.. You get them off the "sauce".... or pay dearly....on down the road. This "road" began in '80...with hills and valleys.... This "might" be my last post....but I'll continue to read everyone's perspective....even Sammy's  . .I'm outta the door....just don't hang a "chad" today

|

||

|

|

|

|

I see you

Join Date: Nov 2002

Location: NJ

Posts: 29,992

|

Whenever it occurs and however bad it gets remember it will be followed by a recovery.

__________________

Si non potes inimicum tuum vincere, habeas eum amicum and ride a big blue trike. "'Bipartisan' usually means that a larger-than-usual deception is being carried out." |

||

|

|

|